The inclusion of the «I» is important as it recognizes the importance of taking the information from all the sensors and processing it into useful knowledge. Information is collected on the battlefield through systematic observation by deployed soldiers and a variety of electronic sensors. Surveillance, target acquisition and reconnaissance are methods of obtaining this information. The information is then passed to intelligence personnel for analysis, and then to the commander and their staff for the formulation of battle plans. Intelligence is processed information that is relevant and contributes to an understanding of the ground, and of enemy dispositions and intents. Most observant Jews also fast from sunset to sunset on the holiday, abstaining from food and water.

- For more information regarding the merger, please refer to the definitive Joint Proxy Statement/Prospectus, dated January 30, 2023, as filed with the Securities and Exchange Commission («SEC»).

- The use of what is the symbol of istar inc. can have different meanings.

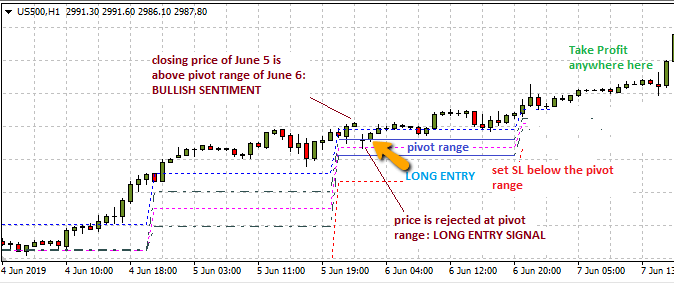

- The Price-to-Earnings (or P/E) ratio is a commonly used tool for valuing a company.

- It’s calculated by multiplying the current market price by the total number of shares outstanding.

Assigns a unique number (a code point) to each character of the major writing methods of the world. In addition includes technical and punctuation characters, and other diverse characters in the writing of texts. The use of Stop loss forex can have different meanings. Use our online application is very simple, only you must click on the what is the symbol of istar inc. you need to copy and it will automatically be stored. IStar (STAR) witnessed a jump in share price last session on above-average trading volume.

Sign-up to receive the latest news and ratings for iStar and its competitors with MarketBeat’s FREE daily newsletter.

iStar Announces Details for Its Special Dividend

Market cap, also known as market capitalization, is the total market value of a company. It’s calculated by multiplying the current market price by the total number of shares outstanding. The 50-day moving average is a frequently used data point by active investors and traders to understand the trend of a stock. It’s calculated by averaging the closing stock price over the previous 50 trading days. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

- Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment.

- The distribution is subject to the satisfaction or waiver of certain conditions, including iStar and Safehold having confirmed that the closing conditions to the merger have been satisfied or waived.

- ISTAR stands for intelligence, surveillance, target acquisition, and reconnaissance.

- For example, a price above its moving average is generally considered an upward trend or a buy.

- Intelligence is processed information that is relevant and contributes to an understanding of the ground, and of enemy dispositions and intents.

ISTAR stands for intelligence, surveillance, target acquisition, and reconnaissance. In its macroscopic sense, ISTAR is a practice that links several battlefield functions together to assist a combat force in employing its sensors and managing the information they gather. No matter how you spend the day, it’s a time to atone in your own way, whether in a synagogue or at home. Synagogues hold religious services throughout the day for practicing Jews to come pray introspectively, either asking for forgiveness or expressing regret of sins committed in the past year. Once you atone, it’s thought to be starting the Jewish new year with a «clean slate,» absolved of past transgressions. ISTAR is the process of integrating the intelligence process with surveillance, target acquisition and reconnaissance tasks in order to improve a commander’s situational awareness and consequently their decision making.

The closing of the merger is subject to certain conditions, as provided in the Agreement and Plan of Merger, dated as of August 10, 2022, between iStar and Safehold. Statements in this press release which are not historical fact may be deemed forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although SAFE believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. SAFE undertakes no obligation to update or publicly revise any forward-looking statement, whether as a result of new information, future events or otherwise. This press release should be read in conjunction with our consolidated financial statements and related notes in our Annual Report on Form 10-K, as amended by Form 10K/A («Form 10-K»), for the year ended December 31, 2022.

View All Business Technology

It’s calculated by dividing the current share price by the earnings per share (or EPS). It can also be calculated by dividing the company’s Market Cap by the Net Profit. IStar currently expects the distribution to be made before the open of trading on March 31, 2023, or on a date as promptly as practicable thereafter, subject to the satisfaction of the conditions to the spin-off.

About iStar (NYSE:STAR) Stock

This isn’t a time for true punishment, but rather a time for uninterrupted reflection. Tomi Kilgore is MarketWatch’s deputy investing and corporate news editor and is based in New York. «This transformative transaction marks a significant milestone for Safehold and iStar stakeholders,» said Jay Sugarman, Chairman and Chief Executive Officer. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. Provides a general description of the business conducted by this company.

what is the symbol of istar inc.

52 week low is the lowest price of a stock in the past 52 weeks, or one year. 52 week high is the highest price of a stock in the past 52 weeks, or one year. Pregnant and breastfeeding women can also skip the fast if they feel so inclined, citing legitimate medical reasons.

Although iStar believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can give no assurance that its expectations will be attained. The Company undertakes no obligation to update or publicly revise any forward-looking statement, whether as a result of new information, Pit Bull future events or otherwise. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer.

Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. The Price-to-Earnings (or P/E) ratio is a commonly used tool for valuing a company.

Heavy Industry & Manufacturing

IStar expects to complete the merger with Safehold immediately following the distribution, subject to the satisfaction of the closing conditions to the merger. The dividend will be paid on a pro rata basis on December 7, 2022 to shareholders of record as of the close of business on December 1, 2022. 1 Wall Street equities research analysts have issued «buy,» «hold,» and «sell» ratings for iStar in the last year. The consensus among Wall Street equities research analysts is that investors should «hold» STAR shares. A hold rating indicates that analysts believe investors should maintain any existing positions they have in STAR, but not buy additional shares or sell existing shares.

Prior to the distribution, shares of iStar common stock that trade in the «regular way» market on the New York Stock Exchange («NYSE») will trade with the right to receive Star Holdings common shares on the distribution date. We expect that the common stock of the combined company in the merger («New Safe») will begin trading on a «when issued» basis on the NYSE on March 27, 2023, without the right to receive Star Holdings common shares in the distribution. After completion of the distribution and the merger, Star Holdings’ common shares will begin trading regular way on the Nasdaq and New Safe common stock will begin trading regular way on the NYSE. This press release should be read in conjunction with our consolidated financial statements and related notes in our Annual Report on Form 10-K («Form 10-K») for the year ended December 31, 2022. No fractional shares of SAFE common stock will be issued in connection with the special dividend, and instead Company stockholders will receive cash in lieu of any fractional shares. «As our business enters this next phase, we are excited to deliver even more benefits to our customers and investors as the leader of the modern ground lease industry,» said Marcos Alvarado, President and Chief Investment Officer.

The Barchart Technical Opinion rating is a 88% Sell with a Weakest short term outlook on maintaining the current direction. Upgrade to MarketBeat All Access to add more stocks to your watchlist. 8 employees have rated iStar Chief Executive best oil etf Officer Jay Sugarman on Glassdoor.com. Jay Sugarman has an approval rating of 100% among the company’s employees. This puts Jay Sugarman in the top 10% of approval ratings compared to other CEOs of publicly-traded companies.